Dual‑Engine Hypergrowth: Harmonizing PLG with ABM, No Funnel Wars Required

Introduction

For more than a decade, B2B SaaS founders have treated Product‑Led Growth (PLG) and Account‑Based Marketing & Sales (ABM/ABX) as mutually exclusive camps, and then have conversations in leadership meetings on why each motion eventually plateaus. In reality, these engines can be complementary synergistic. When you connect both motions, self‑serve sign‑ups build a broad wave of momentum, and focused outreach to enterprise buyers converts that momentum into steady, high‑margin revenue. This article lays out strategic “dual‑engine” blueprints, validated by breakouts like Notion, Figma, and Airtable. And shows in practical detail how to organize data, teams, and campaigns so the two motions amplify rather than cannibalize each other.

Opening Hook – Three Proof Points of Funnel Harmony

In 2016, Notion was a cult favorite note‑taking app with a generous free tier. Viral sharing pushed the user base past 100 million, but true escape velocity arrived only after the team layered account‑based ads and case‑study content at the workspace‑level. Usage data revealed industry clusters; tailored outreach turned bottom‑up adoption into a US$300 million revenue engine in 6 years.

Figma followed a similar arc. Its web‑based design canvas spread through free starter plans and simple URL sharing. Once penetration inside design teams was clear, Figma’s leadership hired an enterprise sales crew, built bespoke security features, and ran targeted ABM plays. By 2024 roughly 70 percent of its revenue flowed from Organization and Enterprise plans, helping ARR rocket past US$900 million.

Meanwhile Airtable used a freemium “land” motion to seed marketing and operations teams, then unleashed data‑driven upsell triggers that expanded seats across entire enterprises. The result: a sprint from US$10 million to US$100 million ARR in three‑and‑a‑half years and triple‑digit growth in its enterprise segment.

Those stories raise two urgent questions for every growth leader:

- Is PLG actually better than ABM for scale, or does the highest slope occur when the two are blended?

- Can the motions truly coexist, or will they cannibalize each other and create channel‑conflict headaches?

This article answers both—with frameworks, metrics, and battle‑tested playbooks.

Expert Perspective: A Decade at the PLG-ABM Crossroads

I’ve spent the past ten years leading demand generation, account‑based marketing, and product‑led growth at Vanta, Auth0, ServiceTitan and for other high‑growth SaaS companies. Twice I have rebuilt a contact‑centered HubSpot CRM into an account‑centered architecture so the business could chase bigger deals without breaking the database. I have managed parallel projects in PLG optimization, nurturing the self‑serve funnel, tightening activation friction, and in ABM orchestration, where clean firmographic data and intent signals determined whether one of our sales development representatives reached out.

Across those roles one lesson stays constant: PLG and ABM succeed fastest when each motion feeds the other instead of fighting for budget or glory. The frameworks below distill those lessons.

Why These Dual‑Engine Motions Exist

The New Shape of SaaS Buying

Modern SaaS buyers rarely begin by speaking with a salesperson. Instead, they explore YouTube tutorials, dive into peer reviews, and test the free tier long before your CRM captures their email. Once a trial shows promise, risk‑minded colleagues (compliance, revOps, legal) step into the conversation, and finance starts weighing budget limits and procurement rules. These added voices can stretch the path from first click to signed contract by weeks.

Field events and trade‑show dinners can still nudge late‑stage deals over the line by adding a handshake to the relationship, yet travel freezes, public‑health concerns, and leaner budgets can slam that door shut as quickly as it opens. Buyers now thread a hybrid path: they binge on on‑demand demos and peer Reddit communities, loop in security and finance reviewers through asynchronous comment chains, and book one short executive call to finalize terms only after they are 90 percent confident. The purchase journey, then, is both self‑serve and committee‑driven. The key question is this: how will your marketing mix harness each of these touch-points and turn them into forward momentum?

The Limits of One‑Sided GTM

Relying solely on a Product‑Led Growth approach attracts throngs of eager users, but momentum fades when enterprise prospects start asking for SOC-2 reports, master services agreements, and formal procurement reviews. Focusing only on an Account‑Based Marketing motion can land marquee customers, yet it overlooks the steady stream of self‑serve sign‑ups that push down blended customer acquisition cost and nurture tomorrow’s champions. Each strategy in isolation leaves both revenue and invaluable product feedback on the table.

The Compounding Effect of Running Both

Instrumentation inside the product reveals which accounts are adding seats, integrating APIs, and inviting executive‑level teammates; those signals flow straight into an account‑scoring model that powers personalized outreach. Conversely, ABM conversations surface feature gaps and compliance blockers that shape the PLG roadmap. The feedback loop shortens sales cycles and deepens stickiness.

Blending PLG’s bottom‑up energy with ABM’s top‑down precision lets a startup grow fast and lock in stable, multi‑year contracts.

Product‑Led Growth Flywheel Refresher

At its core, PLG is a self‑reinforcing flywheel with four stages:

- Acquisition. Users land through template galleries, community‑shared docs, or a Google search. Success metric: sign‑up‑to‑activation rate.

- Activation. The first “aha” moment—creating a project, inviting a teammate, or importing data—should happen within minutes. Measure the percentage of sign‑ups that hit activation in the first 24 hours.

- Expansion. Seat growth, feature adoption, and workspace upgrades drive paid ARR. Track weekly seat delta and incremental revenue.

- Advocacy. Power users publish templates, write reviews, and invite sister teams. Monitor referrals per active account.

North‑star metrics include weekly active users to monthly active users (WAU‑to‑MAU) ratio for stickiness, drop‑off at each conversion step, and the rate at which product‑qualified leads (PQLs) surface. Common pitfalls to be cautious of are gating value too early, ignoring expansion signals like reading help articles, and treating activation as a one‑time checkpoint instead of an ongoing journey. A quick win example: Figma cut activation time by 35 percent when it surfaced an “observe teammate cursor” prompt on first launch, lifting PQL‑to‑paid conversion accordingly.

Account‑Based Marketing Essentials

ABM flips the traditional funnel. Rather than spraying messages at a market segment and hoping the right people respond, you start with a curated list of high‑value companies and orchestrate personalized experiences across every touch-point.

Building Appropriate Lists. First, define an Ideal Customer Profile (ICP) using firmographic and technographic traits, such as size, industry, security posture, integration stack. Next, score accounts by blending that profile with engagement and activity data so champions within active accounts rise to the top. Finally, map the buying committee: end‑users, budget owners, security reviewers, economic buyers.

Plays and Channels. Personalized LinkedIn messages that reference activity levels, one‑to‑one micro-sites with industry case studies, and small executive round tables work well. Every channel in the audience’s funnel, email, in‑app banners, paid social, should echo the same narrative.

Metrics. Focus on account engagement (multi‑channel touches per role), opportunity creation rate, deal velocity, and Lifetime Value (LTV) expansion. Avoid vanity metrics like raw click‑through’s that don’t move pipeline.

Common mistakes include generic communications blasts that ignore usage context, or celebrating webinar registrations that never translate to meetings.

Where the Motions Collide and Complement

The hand‑off between PLG and ABM is the make‑or‑break moment. Reach out too soon and you might interrupt users who are still testing the waters; hesitate too long and a rival vendor could step in and secure the agreement.

Timing the Transition. A pragmatic trigger is an activity threshold: for example, when an account exceeds ten weekly active users and creates its first private workspace, the model upgrades the record from PQL to Marketing‑Qualified Lead (MQL). An SDR then reaches out with a tailored message, “I noticed your design, marketing, and product teams all jumped in last week. Would central SSO and unlimited version history help?”

Avoiding Channel Conflict. Role clarity is vital. Customer success owns in‑app education up to the PQL threshold; Sales Development owns first outbound; Account Executives own commercial negotiation. Compensation plans should reward shared outcomes like Annual Recurring Revenue, not siloed metrics.

Building the Unified Growth Fabric

The dual engine only clicks when information can transfer smoothly between Marketing, Sales, and Product. Think of it as a seamless circuit that keeps data, and leads, scoring and routing in a consistent flow.

Data foundation. Start by pouring every product click, CRM record, and third‑party intent signal into one cloud warehouse: Data Warehouse, Snowflake, BigQuery, or whatever your team already likes. Give every row a shared user_id and account_id so anyone can join tables without wrestling with VLOOKUPs or custom scripts.

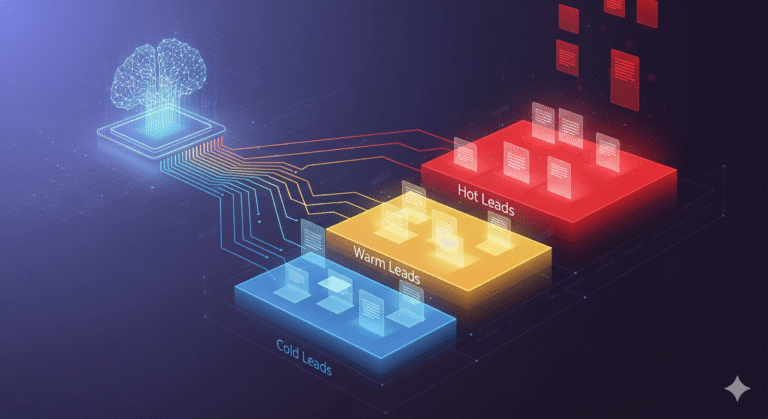

Scoring engine. With all the data in one place, a scoring model evaluates each record or account. It blends three things: ICP fit, in‑product activity, and outside buying intent. The score should refreshes at least daily so reps always see the latest intent.

Routing logic. A reverse ETL (extract, transform, load) tool pushes those scores back into the CRM. High‑score, high‑intent accounts pop onto an SDR’s screen within minutes; lower‑intent ones stay in automated nurture flows until they show stronger signs of life.

You might be asking: “What’s the practical way to turn product‑qualified leads (PQLs) surfaced by PLG analytics into account‑qualified or marketing‑qualified accounts for ABM outreach?” The answer lives in that routing step—when several PQLs roll up to one company and the company’s score crosses the outreach threshold, the system converts them into an Account‑Qualified Lead (AQL) so the SDR can step in.

Another common question is: “Which metrics matter most when you’re running both motions—NRR, expansion ARR, usage depth, engagement score… and how do you normalize them?” Start by tracking the PQL‑to‑Opportunity conversion rate. If that keeps climbing, your hand‑off is healthy. Layer in Net Revenue Retention and expansion ARR to gauge long‑term impact.

Watch those conversion rates quarter over quarter—rising numbers mean the engine is humming.

Campaign Blueprints

Below are five proven campaign blueprints that translate raw product signals into revenue momentum.

Land‑and‑Expand Loop. A free workspace eventually bumps into premium walls such as advanced single sign‑on. An in‑app nudge highlights the missing capability, and an account executive follows up to offer an enterprise demo to showcase the tool to additional neighboring teams and departments.

Scale‑Up Signal. The moment a prospect announces a new funding round, an automated ad sequence positions your enterprise plan as the fuel for their next growth stage, ensuring you join the conversation before a competitor does.

Usage‑Burst Alert. When product usage or daily active users inside an account jump by roughly forty percent week over week, a banner invites administrators to a private webinar where an account executive demonstrates advanced permission controls and outlines upgrade paths.

Feature Sneak Peek. Power users receive early access to an upcoming premium feature. After two weeks, an email series showcases the outcomes they achieved and presents clear avenues to move onto a paid tier.

Webinar Power Hour. High‑usage accounts gather for a live deep‑dive into advanced workflows. The session ends with a time‑boxed discount on the enterprise plan that converts engagement into signed deals.

Each campaign runs on the same instrumentation stack: product analytics tools such as FullStory or Amplitude, enrichment layers like Clearbit, intent data from marketplaces such as G2 or TrustRadius, and orchestration through platforms like HubSpot, Mutiny, or Zapier.

Operational Rhythms & Success Metrics

Hold a weekly sync with Marketing, RevOps, Sales, and Customer Success. Use the session to reference a concise scorecard dashboard that keeps everyone aligned. Focus on Annual Recurring Revenue (split by self‑serve and assisted motions), Gross Revenue Retention (to surface churn before it hides inside averages), blended Customer Acquisition Cost payback period in months, PQL‑to‑opportunity conversion rate (which shows hand‑off quality), new pipeline created in the past seven days, average deal velocity measured in days from MQL to closed‑won, and a quick MQL aged‑over‑48‑hours count that spotlights opportunities without adequate follow‑up. In most teams this entire read‑out can fit on one or two slides and sparks rapid actions.

Outside the meeting, maintain a living dashboard so anyone can check performance at a glance. Beyond the weekly scorecard, display trend lines for metrics such as the following:

- Monthly recurring revenue

- Average revenue per account

- Expansion ARR won

- Trial‑to‑customer conversion rate

- Net Promoter Score (customer‑satisfaction survey results)

- MQL‑to‑SQL ratio

- Sales accepted leads

- Churn broken out by industry and ARR band.

Additionally, add a composite usage‑health score that blends login frequency, core feature usage, and support‑ticket volume. This often predicts upsell or churn opportunities weeks in advance. Finally, include a panel for data‑quality health: duplicate record warnings, missing firmographics, or mismatched user‑to‑account joins, so everyone sees that clean inputs drive trustworthy insights.

Pitfalls & Anti‑Patterns

Even the most well‑crafted dual‑engine strategy can veer off track when familiar pitfalls go unchecked.

Silo thinking shows up when marketing, sales, and product each run their own playbooks with no data exchange. Shared dashboards that draw from a single source of truth in the data warehouse keep everyone steering toward the same objective.

Spraying product‑qualified leads is another quick path to burnout. Treating every new sign‑up as outreach‑ready floods inboxes and lowers conversion rates. Add ICP filters and real engagement intent before a sales development representative reaches out.

Dirty data slows handoffs between teams. Duplicate accounts waste rep hours and confuse attribution. Schedule a monthly hygiene sweep and let enrichment tools back‑fill missing core record fields automatically.

Vanity metrics burn budget without moving pipeline. Celebrating click‑through rates or form fills that never advance opportunities distracts teams from the numbers that matter. Tie every activity to revenue‑influencing key performance indicators and drop campaigns that cannot prove impact.

Misaligned incentives create invisible drag. If the product‑led team chases sign‑ups while sales pursues annual contract value, no one owns expansion. Set a shared Annual Recurring Revenue goal so both groups pull in the same direction.

Spot these pitfalls early, install the fixes up front, and your dual‑engine flywheel stays balanced, efficient, and valued by all teams involved.

The AI‑Powered Growth Horizon

Why AI Matters

The constant flow of information produced by modern SaaS platforms—from feature‑usage events and support tickets to fresh product announcements—moves faster than any human team can interpret on its own. Lightweight ML models can flag upgrade‑ready accounts or churn risk shortly after signal emergence. Generative AI drafts role‑specific landing pages and nurtures sequences in minutes, closing the personalization gap.

Building the Data Layer

Centralize every event stream in the warehouse, standardize keys, model snapshots, and secure sensitive fields. Data‑quality tests catch schema drift early; role‑based access ensures only need‑to‑know teams see PII.

Predictive Scoring Examples

- Tiered Opportunities. Classify users/accounts most likely to convert within a time period.

- Account Fit Score. Rank companies by ICP alignment.

- Expansion Radar. Identify sister departments inside existing customers.

- Churn Risk Alert. Detect 30‑day declines in key action frequency.

Start with a single objective, gather clean data, iterate models, and add complexity only when conversion lift plateaus. Always check for bias, and maintain clarity so teams trust the outputs.

Conclusion & Action Plan

Dual‑engine hyper-growth is not a marketing slogan; it is an operational reality already fueling the next generation of SaaS giants. By harmonizing Product‑Led Growth and Account‑Based Marketing, companies capture the full spectrum of demand, from the lone developer who signs up at midnight to the CFO who signs a seven‑figure enterprise agreement.

Your 30‑Day Plan:

- Assess Your Baseline. Audit activation rates, count PQLs, and list open ABM opportunities.

- Choose One Quick Win. Perhaps add live usage scores to your CRM or spin up a weekly dual‑engine stand‑up.

- Run a Pilot. Target a test audience of high‑usage accounts with a coordinated PLG‑plus‑ABM campaign. Measure conversion changes and share learnings.

Funnel harmony beats funnel wars. Start small, learn fast, and watch your growth engine pick up speed.

References

- What Notion’s $300M Sales Funnel Looks Like: https://www.growth-letter.com/p/what-notions-300m-sales-funnel-looks

- Figma S‑1 Breakdown – On time‑to‑market, going multi‑product, PLG, and profitable growth: https://www.tanayj.com/p/figma-s-1-breakdown

- Airtable Revenue, Valuation & Growth Rate: https://sacra.com/c/airtable/

*This article was created using the support of AI (ChatGPT 4o & Gemini 2.5 Flash)